Inspecting the Process of Bank Credit Rating via Visual Analytics

Qiangqiang Liu, Tangzhi Ye, Zhihua Zhu, Xiaojuan Ma, Quan Li

External link (DOI)

View presentation:2021-10-28T17:20:00ZGMT-0600Change your timezone on the schedule page

2021-10-28T17:20:00Z

Keywords

Dimensionality Reduction, Social Science, Education, Humanities, Journalism, Intelligence Analysis, Knowledge Work, Tabular Data

Abstract

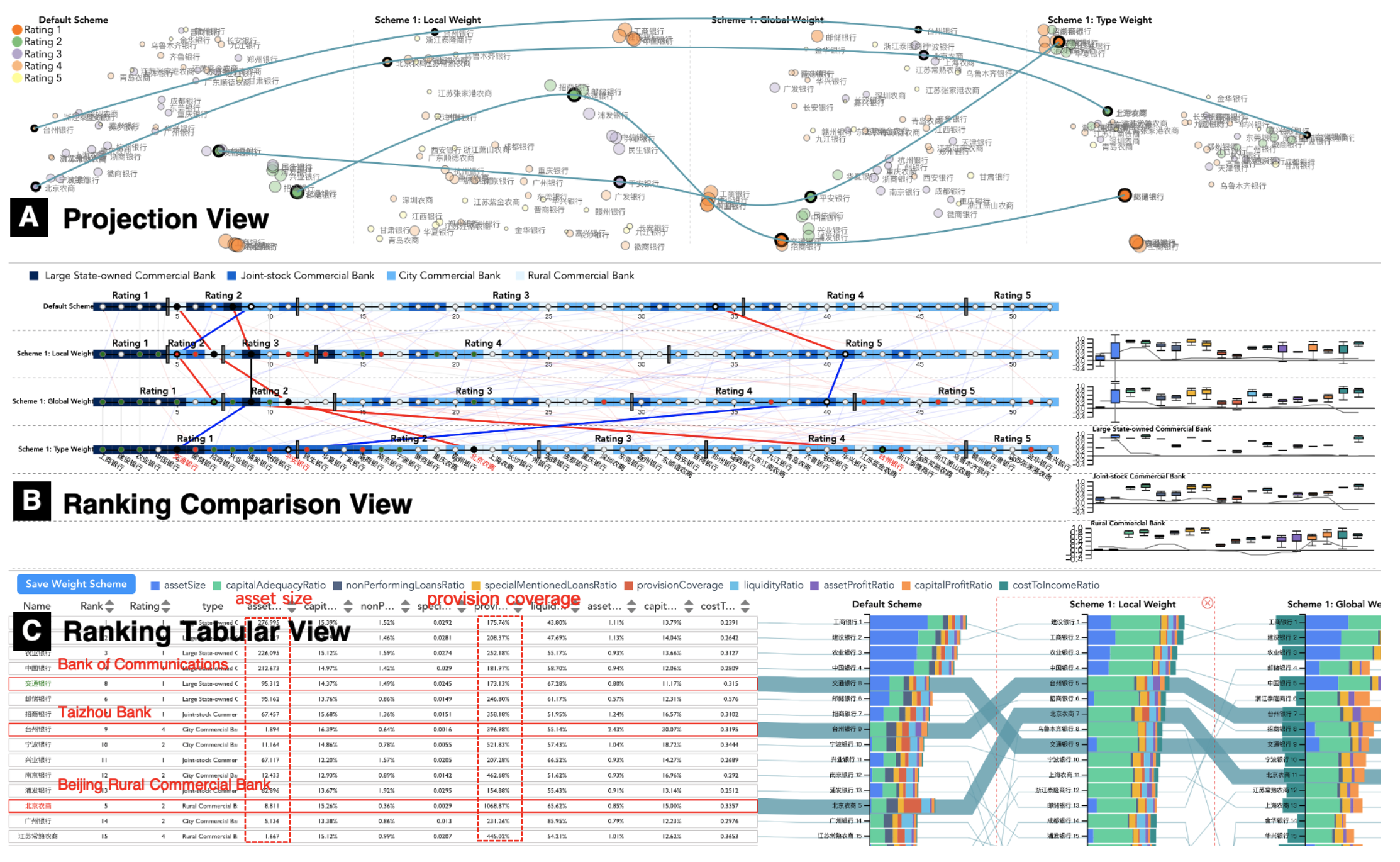

Bank credit rating refers to classify commercial banks into different levels based on publicly disclosed and internal information, serving as an important input in financial risk management. However, experts still have a vague idea of exploring and comparing different bank credit rating schemes. A loose connection between subjective and quantitative analysis and difficulties for the experts in determining appropriate indicator weights obscure understanding of bank credit ratings. Furthermore, existing models fail to consider bank types by just applying a unified indicator weight set to all banks. We propose RatingVis to assist experts in exploring and comparing different bank credit rating schemes. It supports interactively inferring indicator weights for banks by involving domain knowledge and considers bank types in the analysis loop. A real-world case study verifies the efficacy of RatingVis.