iConViz: Interactive Visual Exploration of the Default Contagion Risk of Networked-Guarantee Loans

Zhibin Niu, Runlin Li, Junqi Wu, Dawei Cheng, Jiawan Zhang

External link (DOI)

View presentation:2020-10-30T16:15:00ZGMT-0600Change your timezone on the schedule page

2020-10-30T16:15:00Z

Keywords

Visualization analytics, Regulatory visualization

Abstract

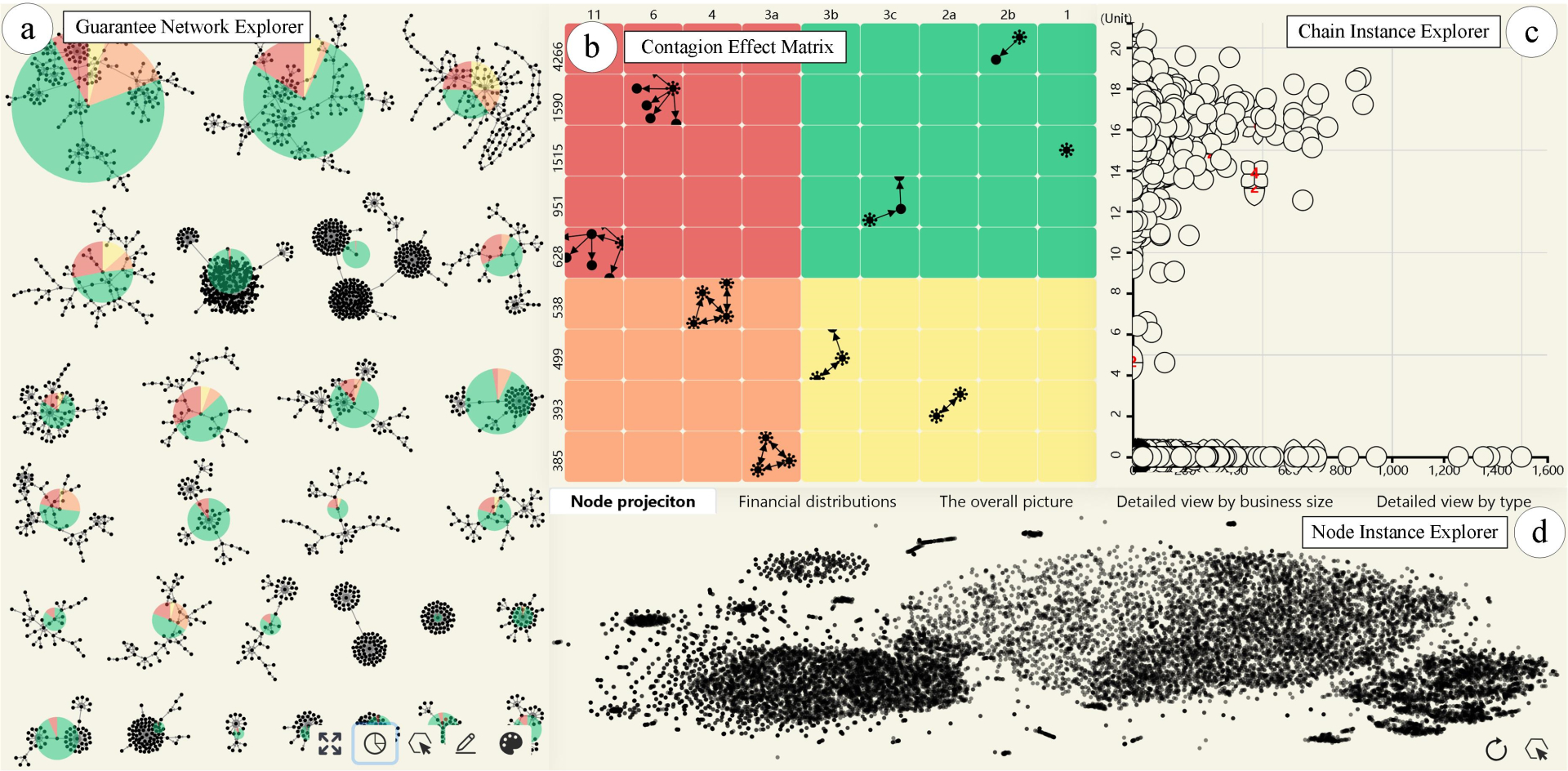

Groups of enterprises can serve as guarantees for one another and form complex networks when obtaining loans from commercial banks. During economic slowdowns, corporate default may spread like a virus and lead to large-scale defaults or even systemic financial crises. To help financial regulatory authorities and banks manage the risk associated with networked loans, we identified the default contagion risk, a pivotal issue in developing preventive measures, and established iConViz, an interactive visual analysis tool that facilitates the closed-loop analysis process. A novel financial metric, the contagion effect, was formulated to quantify the infectious consequences of guarantee chains in this type of network. Based on this metric, we designed and implement a series of novel and coordinated views that address the analysis of financial problems. Experts evaluated the system using real-world financial data. The proposed approach grants practitioners the ability to avoid previous ad hoc analysis methodologies and extend coverage of the conventional Capital Accord to the banking industry.